What are digital signatures?

Digital signatures are offered by MyState Bank whereby customers can review and approve important documents electronically using DocuSign.

How does it work?

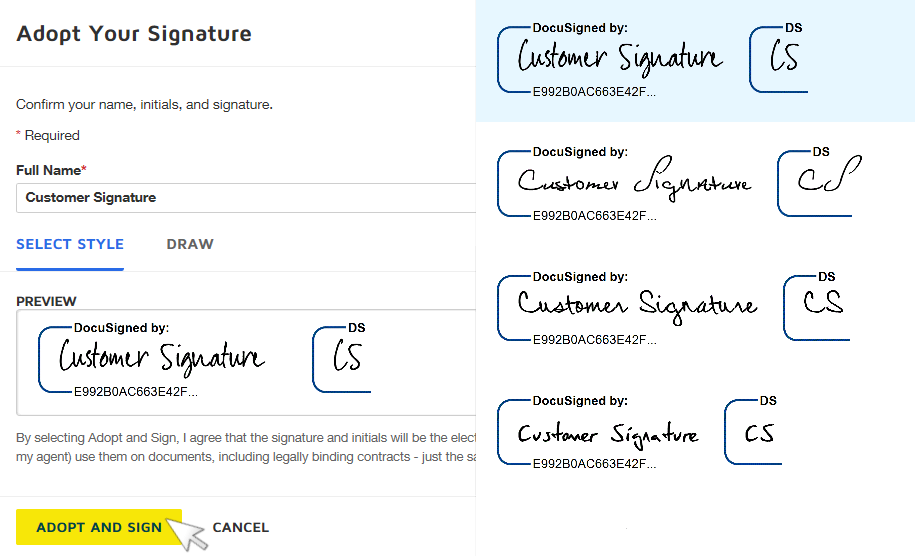

Customers will receive an email with a link to view their loan documents. They need to make sure they have their mobile phone near by. Once they click on Review Documents, they will be prompted to generate an SMS code to enable them to open their documentation. This is an additional layer of security. A 6 digit code will be sent to the mobile phone number we have verified on your customer's profile. They enter the 6 digit code and follow the prompts to set up and adopt a digital signature. By selecting Adopt and Sign, they agree that the signature and initials they have selected will be the electronic representation of their signature, and that it has the same legal binding as a pen and paper signature.

Next, the customer reviews the documents to ensure they are happy with our terms and conditions. Once they are happy to accept the credit offer, they simply click ‘Sign Here’ to apply the electronic approval.

We realise that our customers are busy and may not always be able to complete a full review of loan documents in one session. They may select ‘Finish Later’, and then log back in when they can complete the documents. We’ll even send them a reminder if they forget to review the documents. They have up to 90 days from the date the loan is approved. After this time, the credit offer will expire and the document will be deleted from the system.

If you would like some more information, please see the DocuSign Customer Guide or the DocuSign Broker Guide or you can always check out the official DocuSign support page and their step-by-step instructional guide to signing electronic documents.

Frequently Asked Questions

The email will come from dse@eumail.docusign.net or dse@docusign.net

To ensure the firewall does not block these addresses, we advise customers to add these addresses to their trusted senders list.

If they have not added dse@eumail.docusign.net & dse@docusign.net to their safe senders list, the email may have gone into the junk or spam folder. If it’s not there, they can call the phone number listed in the emailed instructions received.

MyState Bank uses the DocuSign Electronic Signature Service.

Further details about DocuSign and DocuSign’s Privacy Policy are available on their official website at www.docusign.com.au

For additional help with signing you can always check out the Official DocuSign support page and their step by step instructional guide.