To meet ongoing compliance obligations, the following process confirms clients have a clear understanding of what LMI is, and who it covers.

At the time of the loan application, if the loan is 80% LVR or above (or it may be after the valuation), Brokers are required to have a conversation with their client about LMI; the likely costs, what and who it covers.

Our Broker Submission checklist confirms the conversation. The LMI Fact Sheet assists your client to understand LMI and the LMI Declaration/Disclaimer confirms you have fulfilled your obligation.

This process is effective from 1st August 2018.

More information is available on the process and your obligations below:

Forms Checklist

Process

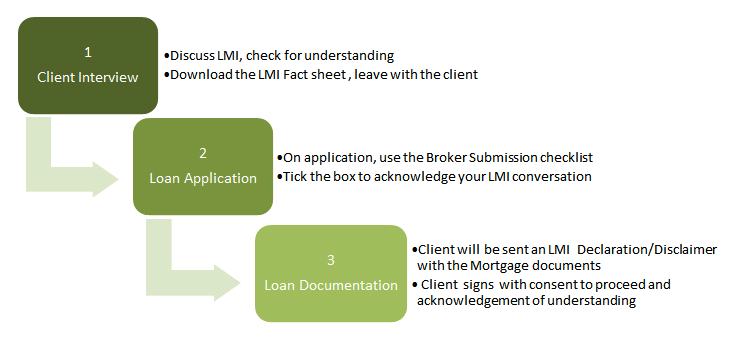

- During the application process, as soon as it is identified (based on LVR) that LMI is required, the Broker is required to discuss all aspects of LMI according (but not limited) to the items included on the checklist and disclaimer.

- Broker must also provide the customer with a copy of the LMI Fact Sheet (this will be stored on the Broker Portal)

- Broker must also advise the customer that an LMI Declaration/Disclaimer will be included in their document pack, which they are required to sign confirming their understanding of LMI, along with another copy of the Fact Sheet.

- Broker must complete the LMI section of the Broker Checklist confirming relevant discussion has been held and Fact Sheet provided.

- NOTE - If it’s not identified at time of application that LMI is required – Underwriting will advise the Broker directly (based on valuation) that LMI will be applicable and request the Broker contact the customer to discuss all requirements regarding LMI and seek their consent to proceed, as per the checklist, and confirm via return email this discussion has been held. Customer will then receive the declaration and Fact Sheet in their pack as per point 3 above. Broker will not be required to complete the checklist again provided an email confirmation is provided to Underwriting.